The Main Principles Of Hard Money Georgia

Wiki Article

The Hard Money Georgia Ideas

Table of Contents6 Easy Facts About Hard Money Georgia DescribedAn Unbiased View of Hard Money GeorgiaThe Only Guide for Hard Money GeorgiaNot known Details About Hard Money Georgia

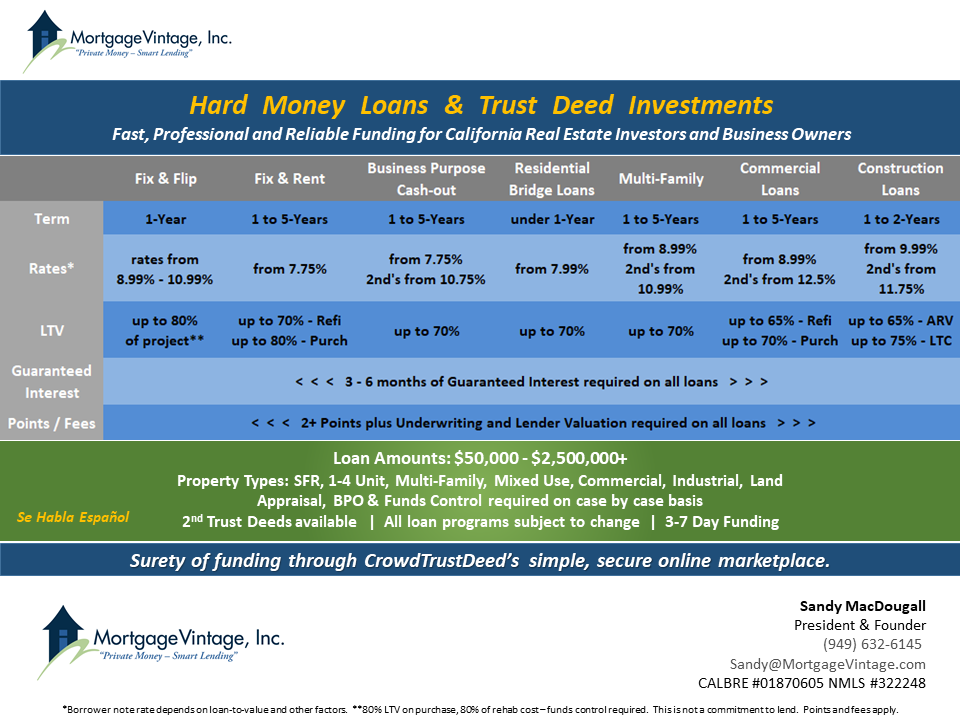

The optimum appropriate LTV for a hard cash financing is commonly 65% to 75%. On a $200,000 house, the maximum a tough cash lender would certainly be ready to lend you is $150,000.

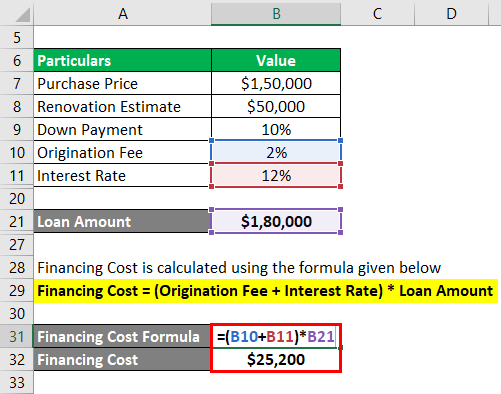

By contrast, interest rates on hard money fundings begin at 6. Difficult cash lending institutions usually bill factors on your loan, sometimes referred to as origination fees.

Points are usually 2% to 3% of the lending amount. Three points on a $200,000 lending would certainly be 3%, or $6,000.

All about Hard Money Georgia

You can expect to pay anywhere from $500 to $2,500 in underwriting costs. Some hard cash lenders additionally charge early repayment penalties, as they make their cash off the interest fees you pay them. That means if you repay the car loan early, you might have to pay an additional fee, including in the loan's expense.This means you're more probable to be provided funding than if you made an application for a conventional home mortgage with a questionable or thin credit report. If you require cash rapidly for improvements to flip a house commercial, a tough money lending can provide you the cash you require without the inconvenience as well as documentation of a traditional mortgage.

It's a method capitalists make use of to buy investments such as rental properties without using a great deal of their own possessions, and also tough cash can be valuable in these scenarios. Although hard cash finances can be beneficial genuine estate financiers, they must be made use of with care especially if you're a beginner to property investing.

If you skip on your car loan settlements with a difficult cash loan provider, the consequences can be serious. Some loans are directly guaranteed so it can harm your credit report.

The 9-Minute Rule for Hard Money Georgia

To discover a reputable loan provider, talk with trusted real estate agents or home mortgage brokers. They might be able to refer you to lenders they've collaborated with in the past. Tough cash lenders likewise frequently participate in investor meetings so that can be an excellent location to link with lenders near you.Equity is the value of the home minus what you still owe on the home loan. Like hard cash lendings, home equity car loans are secured financial debt, which suggests your residential property acts as security. The underwriting for residence equity loans additionally takes your debt background as well as earnings into account so they often tend to have reduced rate of interest rates and also longer payment periods.

When it pertains to funding their following deal, actual estate financiers and business owners are privy to several offering choices virtually produced property. Each features certain needs to gain access to, and also if utilized effectively, can be of significant benefit to financiers. One of these loaning types is difficult cash financing.

It can likewise be described an asset-based financing or a STABBL lending (short-term asset-backed bridge finance) or a bridge lending. These are derived from its characteristic short-term nature and the need for concrete, physical security, usually in the form of genuine estate building.

Hard Money Georgia - An Overview

In the very same capillary, the non-conforming nature manages the lenders a chance to make a decision on their own certain needs. As a result, demands might vary dramatically from lender to loan provider. If you are looking for a car loan for the first time, navigate to this website the authorization process might be reasonably stringent and you might be called for to provide extra info.

This is why they are mainly accessed by actual estate entrepreneurs that would normally require rapid funding in order to not miss out on warm possibilities. In addition, the lender mainly takes into consideration the worth of the property or residential property to find out here be acquired instead than the consumer's individual money background such as credit score or revenue.

A conventional or financial institution loan might occupy to 45 days to shut while a difficult money car loan can be enclosed 7 to 10 days, sometimes sooner. The ease and also rate that difficult money loans offer continue to be a significant driving force for why investor select to use them.

Report this wiki page